The collapse of two major retail chains within weeks of each other last year showed that no company, no matter how iconic or well established, can afford to rest on it’s laurels.

Both BHS and Austin Reed were rightly been accused of not responding to changes in consumer tastes and behaviour. Both notably failed to establish an online presence until it was too late.

But the other misery shared by both these companies was the staggering rents being paid on large, high profile locations that in recent years have exceeded most sane measures of long term economic viability.

The sorts of premises they occupied are testament to a time when rents and rates were regarded more as incidental expenses, rather than the major undertakings they are today. Indeed Austin Reed’s original Regent Street store had thousands of square feet of space left idle, a situation that is not uncommon amongst huge swathes of legacy high street stores today.

Their move to 100 Regent Street in 2011 seemed born of the same extravagance, no doubt driven by the need for them emulate their previously impressive presence across the road. I remember at the time thinking that perhaps what they really needed was not yet another impressive shopfit, but rather a brand realignment. If you’ll excuse the pun, something more tailored to today’s clientèle.

It seems that the disparity between footfall and overheads caught up with them, as it has done with many other retailers in the past few years. It was clear from Edinburgh Woollen Mill’s refusal to take on the majority of the Austin Reed portfolio that their stores, and the associated costs, were not an attractive aspect of the brand. Indeed, as with BHS, they were seen as something of a millstone.

Solutions

In the past many retailers saw pre-pack administrations as the magic solution to these troubles, much to the particular consternation of landlords. But of late, the CVA has been touted as the magic wand that will resolve problem leases in a fairer and more transparent way. Something else that BHS and Austin Reed had in common.

Unfortunately though, these instruments are not the lifeline they appear to be at the time. In fact they seem to be more a staging post on the road to inevitable demise. How many retailers have we seen entering into CVAs – sometimes more than one – only to slip over the edge into oblivion a few months or even weeks later?

I know from personal experience that the CVA idea seems attractive when the wolf is at the door and the rent demands are on the doormat. On face value, a plan that provides some much needed elbow room seems an irresistible prospect. But it’s usually a false dawn. In general a CVA is only considered as a last resort, by which time there are too many other problems to overcome. It then just becomes another drag on any turnaround plan.

In the past many retailers saw pre-pack administrations as the solution to these troubles, much to the particular consternation of landlords.

Ultimately these sorts of agreements are only going to help if the core business is strong enough to service it’s liabilities in the long term. They are essentially consolidation plans, enabling companies who have hit short term difficulties to ride them out, but they’re not without cost. If the rot is already widespread they’re really just the last grasp at the straw.

After going through CVA proposals made to us by consultants in 2006, I decided that a lasting solution could only be achieved through direct negotiation with our landlords. It worked for us, but we were operating in a different climate back then. Or perhaps I was just very persuasive!

Silver Lining

It’s likely that we’ll see more collapses like those we saw last year, especially as new rates valuations come into force in April. M&S have already announced the closure of a raft of stores amid advice that property is one of its biggest “headaches”. Even though they have yet to confirm exactly which stores will close, this might be the first strains of the alarm bells ringing in the retail property market.

The only silver lining in this grim prediction is that this may be a wake up call that there needs to be more open and direct dialogue with landlords, before the next over-rented portfolio blows up in their, and their tenant’s, faces.

Of course there were plenty of eager new retailers salivating over the prospect of taking on some of the more salubrious locations that Austin Reed vacated. But I doubt any of them will have the same longevity as their predecessors , especially if rents – and their close cousins, business rates – continue to narrow the margin between long term success and sudden death.

We all know that business never stands still and heritage alone is no substitute for innovation. But if our shopping experience is going to remain vibrant and diverse there has to be enough oxygen in the room for both the old and the new to survive.

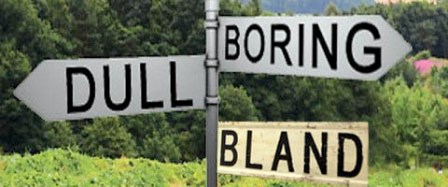

A high street monoculture, where success is measured only by how much you can afford to pay per square foot, is fast becoming the norm. And as with any factory farming ethos, the result is often bland, tasteless and boring.